When we think of insurance, we usually think of health insurance. It’s not a secret that health insurance has so many great benefits. But what are these benefits exactly? Not everyone is truly aware of what health insurance is nor the types of insurance. And, they might know health insurance is beneficial but they don’t know how.

If you want to learn more about health insurance and what it is as well as why it is so popular, keep on reading. We’ll discuss everything about health insurance from its definition to the types of health insurance and some benefits you’ll love if you get health insurance.

WHAT IS HEALTH INSURANCE?

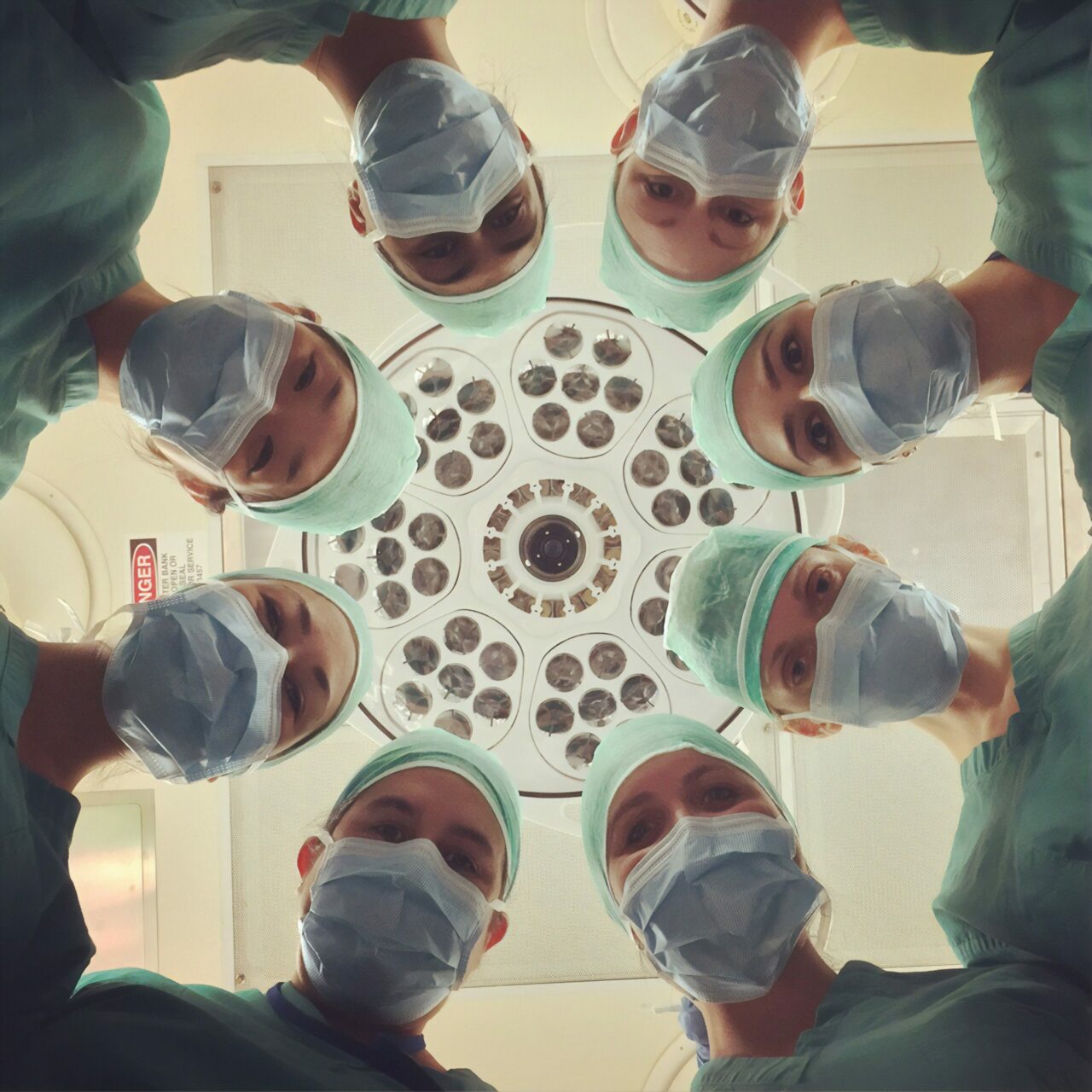

Let’s start with the basics. What is it? Health insurance is a type of insurance that helps you with anything medical-related from surgeries and buying medicine to dental expenses. So long as you are insured, you won’t have to pay much for your medical expenses. Your health insurance company will either pay your care provider directly or reimburse you for any expenses.

Say you suffer from a chronic illness and you get hospitalized. Hospital bills are incredibly expensive and they’ll definitely hurt your wallet and savings. Your health insurance can cover your hospital bills so you don’t have to spend a single penny on your medical expenses. You’ll just have to pay the insurance company a fee for their services.

3 TYPES OF HEALTH INSURANCE

Private Health Insurance

The first type of health insurance you should know about is private health insurance. This is one of the main types and it refers to health insurance coverage that a private entity offers. This does not include any health insurance that comes from the government. So if you get health insurance from an insurance company that is not affiliated with the government, you’re getting private health insurance.

Public or Government Health Insurance

The other main type of health insurance is the opposite of the first one. It’s public or government health insurance. This means you’re getting your health insurance coverage from the government. Your insurance provider is the government may it be local, state, or anything else.

Managed Care Plans

An honorable mention is the managed care plan. Though this is not a main type, this is something worth mentioning. Here, the insurer will provide lower-cost medical care to the policyholders through contracts made with different providers. This is a cheaper and less expensive option.

BENEFITS OF GETTING HEALTH INSURANCE

It’s a safety net.

The first and biggest benefit of health insurance is it acts as a safety net. No one likes all those unexpected costs that come out of nowhere. And getting sick or injured and needing immediate medical attention falls into that category.

When this does happen and you or whoever has fallen ill or injured is insured, you won’t need to add financial problems to the weight on your shoulders. Your health insurance will cover costs like expensive prescription drugs and surgeries.

It can help you prevent illness.

Believe it or not, health insurance can help you prevent illness. Well, not in the literal sense, of course. Just because you have health insurance does not make you immune to illnesses.

What we mean here is that when you have good health insurance, you have access to preventative health care like check-ups with your doctor or scans and vaccines you need. You’ll now be able to afford routine healthcare meaning you can get yourself checked up to see if everything is ok.

THE TAKEAWAY

If you don’t already have health insurance, you should consider getting yourself insured. There are tons of benefits and all you really have to do is choose a great plan that won’t cost you too much but still protect you and give you some peace of mind. Getting health insurance will be a great decision with even better effects.